Being able to see how much business you have written and how much that is worth to you, is essential. It allows you to see trends within your business, when things are looking up, or when things aren’t going so well. You can also see who is writing what business type, how much that is worth to the business and if any support, training or diversification is required.

Pipeline Management

From the very first Lead through to Income & Commissions, we have it covered.

MORTGAGES | INSURANCE | INVESTMENTS | PENSIONS

Pipeline Tracking

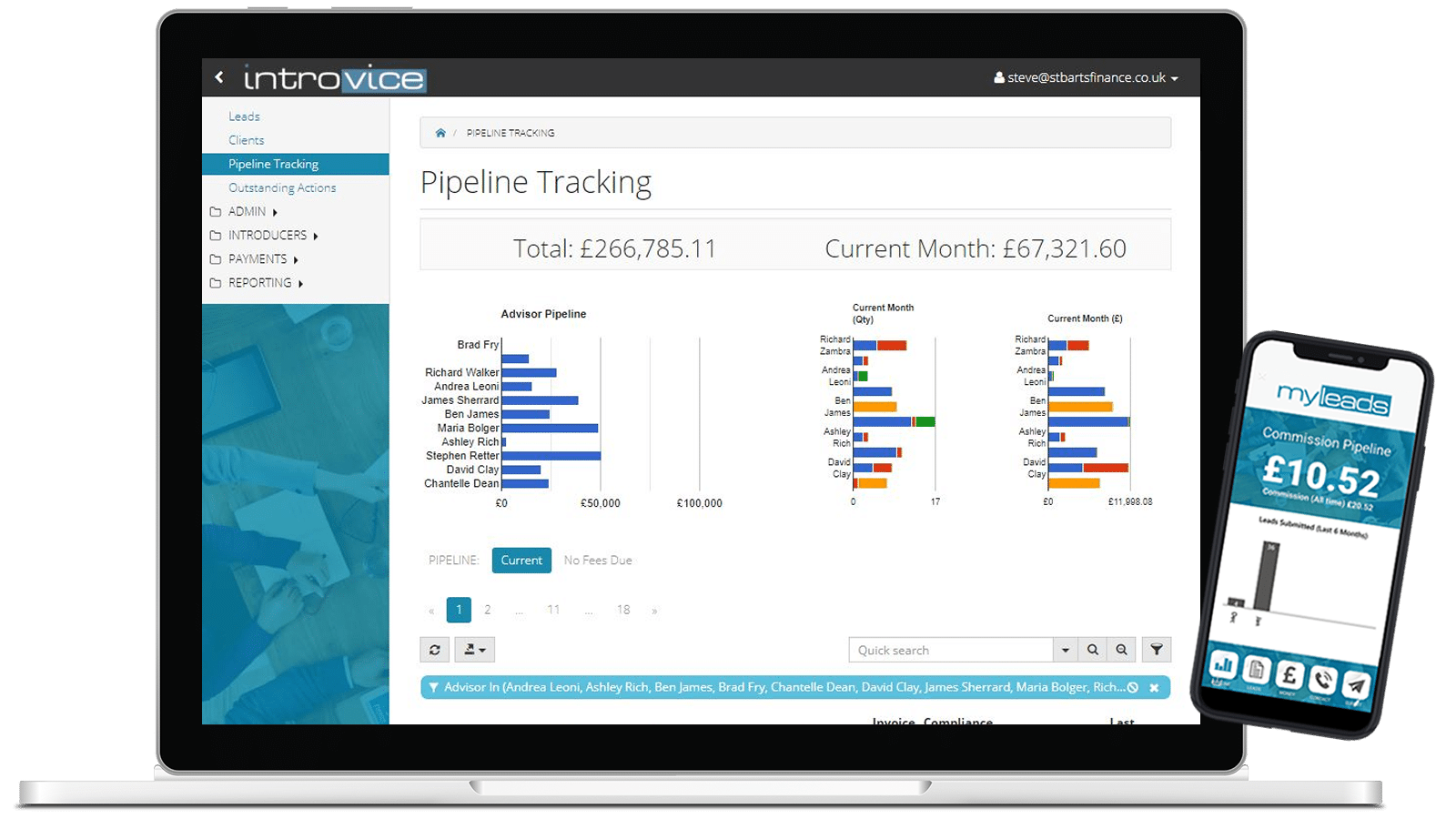

Our software allows you to track all of your Advisors in real-time. You can see what business they currently have in their pipeline and who is performing better than others. You can filter all the data on this screen in many different ways.

Change the status to only ‘Completed’ and the figures on the chart above then only give you this data, allowing you to see what money is guaranteed to pay. Filter the data by specific Advisors to just see and compare their data.

You can also see who has written what business and the value for the current month. This is great for business management but also for the Advisors, as they can see how they are performing against each other.

5. Statistics

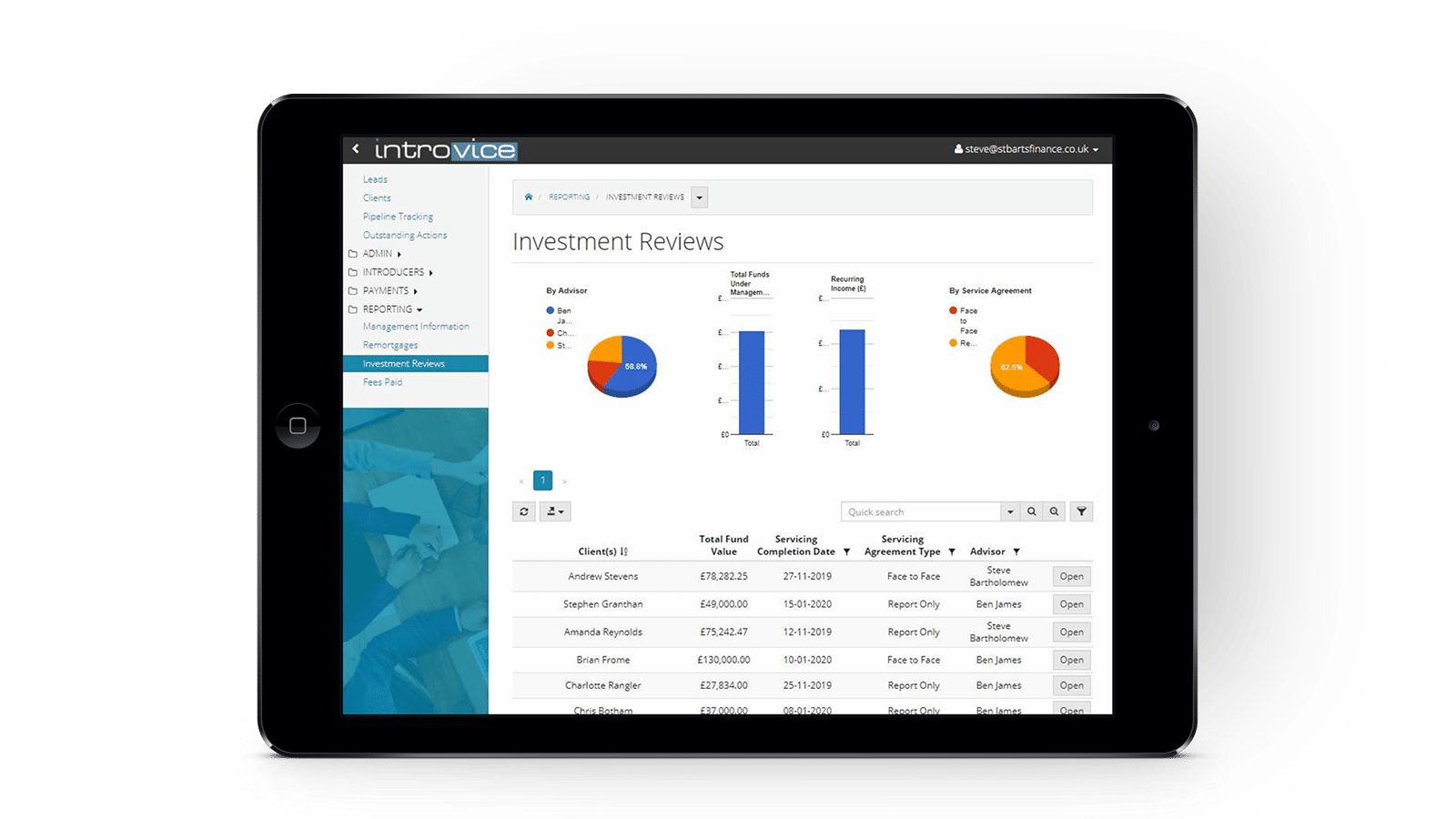

By using the Reporting part of our software, you have the ability to see conversion rates, averages, product levels, your business mix, new vs existing clients, values and premiums. All of this data can be filtered by one or more advisors, the whole company and by any date range that you like.

By getting hold of your data and analysing it in a very quick, easy way, you can start seeing trends in your business. you can see what is working well for you (or not), you can see average fees charged ad if this needs amending, etc. Effectively using the data held within your business, whether you are a sole trader or a business with 100’s of staff, is key to managing your business efficiently.

We have tried to make managing your business and lead/client management as easy as possible. So what we have also done is added Remortgages and Investment Reviews into the mix.

Every time that you change the status of a mortgage or Investment product to ‘Completed’, that product will then be added to your Remortgage Que or Investment Review Que (without the need for you to do anything extra).

It will then email you at various stages before the due date (mortgage ERC date or on an Investment Review anniversary date) a pre-populated client email that the Advisor can then choose to either forward on to the client or simply call them instead. Ensuring that you never miss any future business opportunities or servicing requirements.

6. Money

Once you have built your own commission models into our system, you can use these with any Introducer that you then register. At this stage, you can virtually forget about this and carry on with your normal work. Our software calculates all commission due to everyone and will generate you a report at the end of each month confirming what payments need to be made to who and to what accounts these need to paid to.

For commission due to Advisors or yourself, we have a section called Fees Paid which keeps track of all money paid in any month and so Advisors can go in, filter this data and see how much they are due, at any stage throughout the month (with no need to ask management).

The Outcome

Knowledge is power. By having all of your data managed in one place, with easy to view screens and filters, you have the power to fully understand your business.

Making a decision about growing or changing your business is a major thing. Doing this with the certainty that you are making the right call is essential.

To effectively manage your business, you need to know what everyone is doing, when and why.

When looking to sell your business, having all your data readily accessible and proving your conversion rates on new and existing business, makes your business worth more.