With rising customer expectations and intense competition within financial services its essential to focus attention on customer satisfaction and retention. From banking to insurance to wealth management and mortgages, the financial sector is realising the need for CRM software to improve customer processes and communication across the whole organisation internally and externally.

The Benefits of a Customer Relationship Management Strategy in Financial Services

Benefits of CRM

Lead generation is key and developing these prospects into retained clients is made simpler with a dedicated CRM. Implementing a well utilised Customer Relationship Management (CRM) system can allow finance companies to deliver exceptional customer service by improving their data management, scalability, opportunities and decision-making tactics.

Loyalty in financial services especially in the broker arena is becoming increasingly competitive due to the rise and popularity of comparison tools. Access to the internet and social media make it more accessible for your existing clients to discover the competition or purchase products and services in a different way. To compete in this market now, more emphasis has to be made on personalised service and your company reputation. The best way to do this is with a fine tuned CRM system automating your customer journey reminding your employees to interact and ultimately highlight opportunities to your team and customer.

Why is CRM needed in the Financial Sector?

When operating in a customer focused sector, poor processes and practises are what can make or break a business. Limitations in communication, service and delivery are enough to put any customer off using your business and worst still damage your reputation for new customers. A CRM system will help you manage and track your customer information in such a way that when done correctly could help you deliver a much better service than your competitors.

Introducing CRM software into your business could lead to:

- Improved Customer Service – With a CRM system, information on your clients is stored in a handy database readily accessible to all of your employees. Each interaction with this customer is documented ensuring that when that client contacts, your employees are able to retrieve their information with ease. The contact history feature is extremely useful when dealing with long standing clients. It provides the client with continuity and trust that even if whoever they interact with at your business they will be informed on the clients personal circumstances, they will have access to the same information and be dealt with consistently.Long standing customers stay with particular companies when they are comfortable with their processes and procedures. Making these difficult is going to damage your relationship with the customer making them far more likely to look elsewhere.

Implementing a CRM reduces the time it takes to access that client’s informationtherefore reducing operating costs and minimising the time it takes to handle client’s needs in a prompt and professional manner. - Increased efficiency and profitability – CRM software will streamline your operation by allowing your staff to access customer information faster. This allows them to make quicker, more informed decisions, it reduces training costs as using one system reduces the complexities of their job and ensures compliance within your organisation. Streamlining your operation ensures that each interaction with your customers is handled in the quickest and most cost-effective way. Increasing customer satisfaction and improves efficiency within the workplace.

- Improved Target Market – Ascertaining and understanding your target market gives you the following benefits:

- Improved customer relationships increasing repeat business and client referrals.

- The CRM stores all data on your clients, this gives your whole team a better understanding of their needs. Increased client data allows your team to discover new and existing opportunities.

- Long term customers are more likely to refer your business to others.

A CRM software can help you identify the issues that customers are having within your company and allows you to match them up with a better product or service that is able to meet their needs more effectively.From this perspective a CRM system is not only essential for staying competitive to new customers but for ensuring that you stay current to your existing customers needs. As technology has improved so have CRM systems, you are now able to collate the information stored in these systems to drive a more consistent customer experience throughout all the products and services that you offer. It gives you the ability to segment demographics and highlight customer needs quickly.As technology has grown so has the demand for a prompt and accurate customer experience. Implementing a customer journey and actively spotting opportunities for to match your clients needs will help maintain a log lasting relationship.

A sophisticated CRM system gives you a greater understanding of your target demographic giving you the power to develop your marketing campaigns and generate more leads and improve conversions on new and retention business.

Automatic processes enable you to access analytics that draws conclusions on future customer behaviour and how best to react to that to ensure that you are offering the best products and services for your customers.

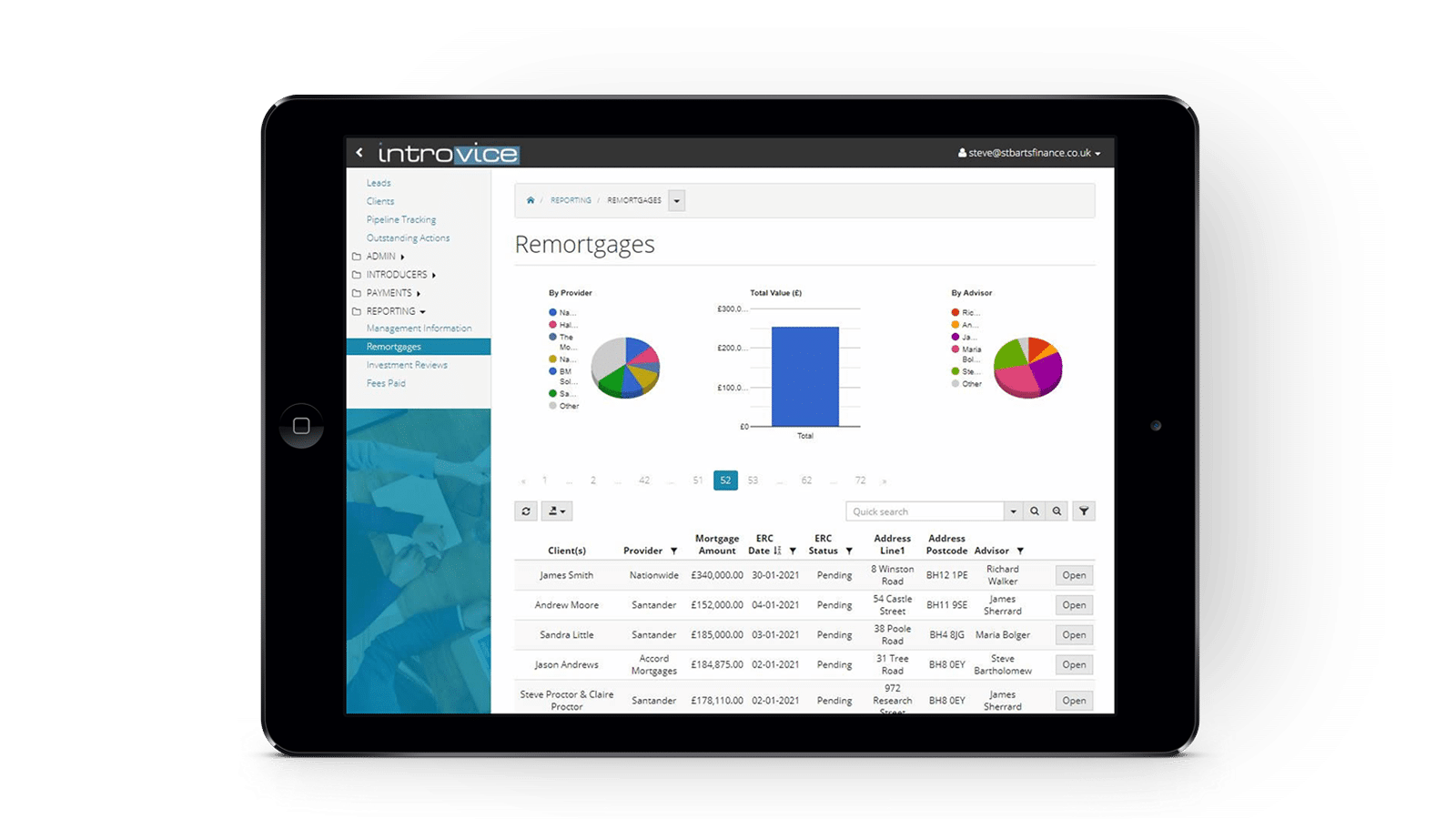

Introvice is fully tailored for the financial services sector it is not just a CRM and has the ability to manage introducer leads, APP integration, commission pipeline values & and produce management information.